It’s December already, can you believe it? Where does a year go? With the year coming to a close, you may hear a lot about “Section 179” and how you’re business can benefit if you are looking to purchase some equipment before 2013.

We get just as confused as the next guy when you start talking “tax rate”, “deductions” and “depreciation”. We thought we would do a little research and try to explain how this could be a HUGE benefit to small businesses.

When we say ‘equipment’, we mean any large purchase you buy to benefit your business. Some examples: a paint booth to help your productivity, a car lift to increase your repair business or a frame machine for the busy winter months. If your business needs it to increase business and it’s an ‘investment’, it is most likely included in this category.

You can even finance it in 2013, but write it off in 2012 and save thousands.

So, section179 is what exactly? It’s an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves. Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment purchased (or financed) during the tax year. Wow! The FULL PURCHASE PRICE will be deducted from your gross income. (As long as the total purchase price is less than 139,000.)

Several years ago, Section 179 was often referred to as the “SUV Tax Loophole” or the “Hummer Deduction” because many businesses have used this tax code to write-off the purchase of qualifying vehicles at the time. Today, Section 179 is one of the few incentives included in any of the recent Stimulus Bills that actually helps small businesses.

Essentially, Section 179 works like this:

When your business buys certain items of equipment, it typically gets to write them off a little at a time through depreciation. In other words, if your company spends $50,000 on a machine, it gets to write off (say) $10,000 a year for five years (these numbers are only meant to give you an example).

Now, while it’s true that this is better than no write off at all, most business owners would really prefer to write off the entire equipment purchase price for the year they buy it.

In fact, if a business could write off the entire amount, they might add more equipment this year instead of waiting over the next few years. That’s the whole purpose behind Section 179 – to motivate the American economy (and your business) to move in a positive direction.

How much Can Section 179 Really Save You? THOUSANDS!

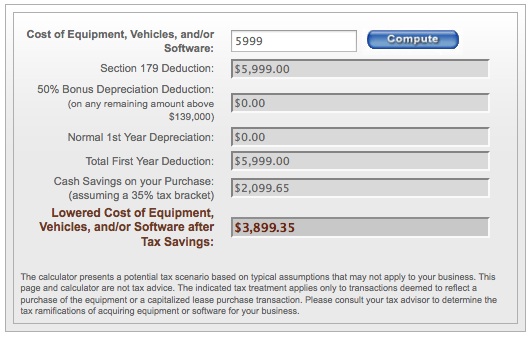

If you decided to purchase our CF-1000 Paint Booth at Our Sales Price of $5999, you would end up paying only $3899! Here’s how the Tax incentive would Work:

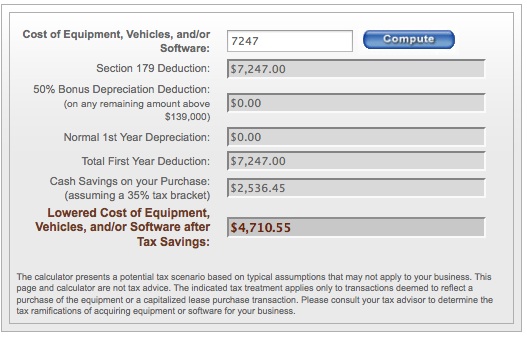

If you wanted to purchase our “Big Boy Build-a-Shop” Special and get everything you need to improve your business, you would save $2536 by purchasing it before January 1, 2013! Here’s how:

If you wanted to purchase our “Big Boy Build-a-Shop” Special and get everything you need to improve your business, you would save $2536 by purchasing it before January 1, 2013! Here’s how:

IN A NUTSHELL:

2012 Deduction Limit = $139,000

This is good on new and used equipment, as well as off-the-shelf software.

2012 Limit on equipment purchases = $560,000

This is the maximum amount that can be spent on equipment before the Section 179 Deduction available to your company begins to be reduced.

Bonus Depreciation = 50%

This is taken after the $560k limit in capital equipment purchases is reached. Note: Bonus Depreciation is available for new equipment only. Bonus Depreciation can also be taken by businesses that will have net operating losses in 2012.

With only 18 shipping days this month, you better order early to ensure you get yours!

Get more information on Section 179 at http://www.section179.org/.